Boasting a colossal 6.4 million active users, Zerodha has transcended into India’s premier stock brokerage firm, reshaping the financial landscape. This bootstrapped startup’s meteoric rise disrupts traditional norms while fostering widespread investment participation. Behind this triumph lies a customer-centric marketing strategy, emphasizing education, innovation, and simplification. In this comprehensive analysis, we delve into the strategic elements fueling Zerodha’s unparalleled success, extracting valuable lessons for the financial services industry.

👉 Introduction to Zerodha: Pioneers of Accessible Investing

Founded on August 15, 2010, in Bengaluru, Karnataka, Zerodha revolutionized the brokerage sector as India’s first discount broker. Its name, a fusion of ‘Zero’ and ‘Rodha’ (barrier in Sanskrit), reflects its mission to make investing barrier-free. With over 4,000 employees across 20+ cities, Zerodha commands an impressive 19.6% market share among retail brokerages in India, achieving profitability since inception without external investment.

👉 The Visionary Behind Zerodha: Nithin Kamath’s Quest for Inclusive Trading

Nithin Kamath, Zerodha’s co-founder, identified the prohibitive costs hindering young traders. His vision birthed an internet brokerage prioritizing people over profits, leveraging cutting-edge technology. Zerodha’s inception aimed at dismantling barriers with digitalization and a user-friendly platform. Kamath’s commitment to prioritize accessibility over profits defines Zerodha’s revolutionary incarnation in the financial realm. Join the revolution, where innovation knows no bounds, and every investment paves the way for a limitless financial future.

👉 The Imperative of a Robust Marketing Plan for Financial Services

Trust, credibility, and reliability are paramount in financial services. Thus, a well-crafted marketing plan is not just beneficial but essential. Here’s a comprehensive exploration of why a proper marketing plan is crucial for financial services.

✨ Building Trust and Credibility:

Financial services operate in a realm where clients entrust their hard-earned money and financial well-being to the service provider. A meticulously devised marketing plan helps establish and reinforce trust and credibility. By articulating the company’s values, principles, and commitment to clients, the plan creates a narrative that resonates with the audience, instilling confidence in the financial institution’s capabilities.

✨ Differentiation in a Crowded Market:

The financial services sector is highly competitive, with numerous players vying for the attention of potential clients. A well-defined marketing plan becomes a strategic tool for differentiation. It helps articulate the unique value proposition, showcasing what sets the financial service provider apart from the competition. Whether it’s innovative offerings, personalized services, or superior technology, a clear marketing strategy communicates these differentiators effectively.

✨ Targeting the Right Audience:

A tailored marketing plan enables financial institutions to identify and target the right audience. Understanding the demographics, needs, and preferences of potential clients ensures that marketing efforts are directed toward those most likely to benefit from the services offered. This targeted approach not only optimizes resources but also enhances the efficiency of customer acquisition and retention efforts.

✨ Compliance and Regulatory Alignment:

Financial services operate in a highly regulated environment. A robust marketing plan ensures alignment with industry regulations and compliance standards. It guides the creation of marketing materials, campaigns, and communications to ensure they adhere to legal requirements. This not only safeguards the institution from regulatory pitfalls but also reinforces a commitment to transparency and ethical practices.

✨ Enhancing Brand Awareness:

Brand recognition is a powerful asset in the financial services sector. A well-executed marketing plan contributes significantly to enhancing brand awareness. Through consistent messaging across various channels, financial institutions can elevate their visibility in the market. Increased brand awareness not only attracts new clients but also fosters a sense of familiarity and trust among existing ones.

✨ Educating Clients:

Financial services often involve complex concepts and products that may be challenging for clients to understand. An effective marketing plan includes educational components that demystify financial intricacies. By providing valuable information, insights, and resources, financial institutions empower clients to make informed decisions, fostering a sense of confidence and control over their financial matters.

✨ Adapting to Market Trends:

The financial landscape is dynamic, with market trends, technological advancements, and consumer preferences evolving rapidly. A well-structured marketing plan ensures agility by incorporating mechanisms to adapt to changing market dynamics. Whether it’s embracing new technologies, responding to emerging trends, or addressing shifting consumer expectations, a flexible marketing strategy positions financial institutions to navigate change successfully.

👉 Zerodha’s Genius Marketing Strategy that Ensured Success

Here are the steller marketing strategy that brought Zerodha’s success:

✨ Transparent Proposition for a Clear Approach to Client Trust

From its inception, Zerodha recognized the skepticism surrounding brokerage services, particularly when it comes to managing finances. In response, the company crafted a standard proposition marked by absolute transparency. In a market cluttered with irrational pricing and obscure terms, Zerodha chose a different path – a path where zero commitments became their hallmark. This straightforward approach resonated well with users who appreciated the clarity evident not only in their standard proposition but also in the FAQ section. Zerodha firmly believes in dissolving confusion, ensuring that every client navigates the world of investments with absolute clarity.

✨ Client Acquisition Focus to Build Success through New Accounts

The second pillar of Zerodha’s success story lies in their strategic emphasis on expanding their user base. Unlike traditional brokerages with relationship managers and dealers, Zerodha adopted a different approach – a relentless focus on acquiring new clients. Today, the company boasts a staggering 2.3 million clients, a testament to their commitment to growth through an ever-expanding customer base.

✨ Referral Rewards and Affiliates for Trust-Fueled Growth Strategies

At the core of Zerodha’s marketing prowess is its robust referral and affiliate programs. In a departure from traditional advertising, the company opted for a model where referrals earned commissions. Bloggers and YouTubers, drawn by the prospect of commission through affiliate programs, became powerful advocates, attracting a stream of leads without any upfront costs. This innovative referral program not only expanded Zerodha’s reach but also fostered a sense of trust, as users discovered the platform through recommendations from trusted sources.

✨ Tech Innovation Drive- Staying at the Forefront of Change

Recognizing the imperativeness of innovation for sustained growth, Zerodha consistently leveraged technology to offer cutting-edge solutions. Applications like Kite and Pi showcased their commitment to staying ahead in the ever-evolving landscape. While the platform started with fundamental features, Zerodha made continuous improvements by adding advanced features such as API integrations and third-party applications. This dedication to innovation ensures that users stay engaged and, crucially, prevents monotony by introducing new elements regularly.

✨ Empowering Users through Education and Digital Marketing

Understanding the digital age’s significance, Zerodha actively engaged users online, providing education through blogs and other informative content. The platform’s Varsity initiative became a valuable resource, offering educational content that not only enhanced users’ knowledge but also drew substantial traffic. Beyond just creating an online presence, Zerodha realized the importance of digital marketing in building a subscriber base and bolstering their domain authority. Users found the service more genuine as they gained something substantial in return – knowledge about the stock market and trading.

✨ Strategic Disengagement to Prioritize Quality Over Quantity

In the competitive landscape of e-commerce, the dichotomy between customer acquisition and retention takes center stage. While most businesses focus on acquiring a vast customer base, Zerodha opted for a more nuanced approach—meaningful disengagement. Unlike competitors who invested heavily in referral sharing to boost app downloads, Zerodha refrained from such expenditures. Recognizing their target audience as young professionals and serious traders, Zerodha understood that financial incentives wouldn’t attract them. This strategic disengagement led to a smaller user base, but one with significantly higher revenue per user. The result: optimized operating costs and soaring net profits.

✨ Revenue Optimization- The Art of Financial Efficiency

While other brokers might offer services for free, Zerodha takes a different route by charging account maintenance and joining fees. This seemingly counterintuitive move serves to eliminate maintenance costs, ultimately contributing to increased net profits. Moreover, the joining fees act as a tip to the annual revenue, creating an additional stream that bolsters the overall financial health of the platform.

✨ Quality-Driven User Acquisition with a Reward-Free Approach

Zerodha stands out in its refusal to offer rewards for app downloads. While competitors may lure leisure users with enticing rewards, Zerodha maintains a focus on attracting serious traders. This deliberate choice shapes a user base that aligns with the platform’s goals, even if it means losing out on the volume of app downloads. By prioritizing quality over quantity in user acquisition, Zerodha reinforces its commitment to a user demographic that drives sustained revenue.

✨ Innovative Ecosystem for Building Value-Added Features

Zerodha’s innovative approach extends beyond disengagement strategies to the creation of a comprehensive ecosystem. Drawing inspiration from industry giants like Apple Inc., Zerodha introduced a suite of apps designed to revolutionize the trading and investment experience. Among the standout features are:

-

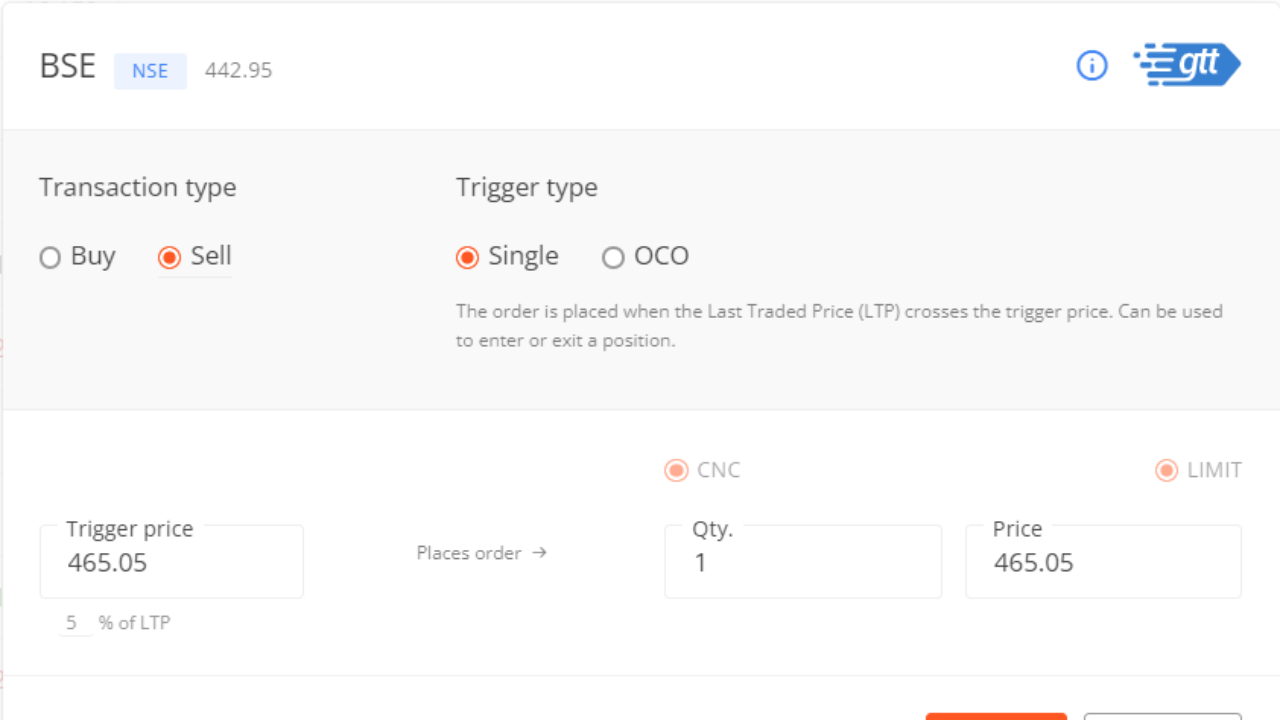

GTT: Good Till Triggered

Zerodha pioneered the introduction of the Good Till Triggered (GTT) feature, allowing investors to set stop loss or buy orders for any stock until it reaches a specified price point. Unlike conventional buy orders with daily expirations, GTT automates buy/sell orders, remaining valid for an entire year. This time-saving functionality caters to traders handling multiple stocks, enhancing efficiency.

-

Nudge: A Balancing Act in Market Volatility

Addressing the challenges of market volatility, Zerodha’s Nudge feature intervenes during market falls. Recognizing the tendency of investors to make impulsive decisions during such times, Nudge offers a preemptive warning before stock transactions. It not only cautions against hasty decisions but also provides insights into the rationale behind price movements, empowering investors with informed choices.

-

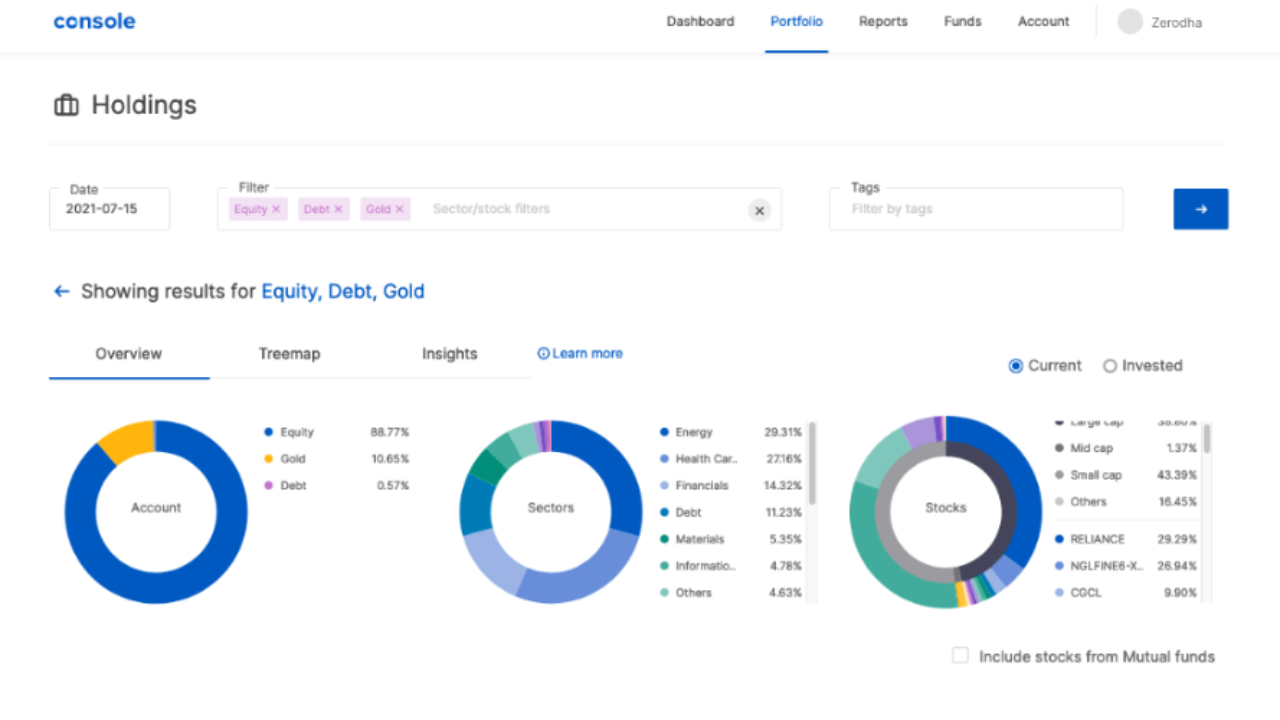

Console: Streamlining Portfolio Management

The Console feature provides investors with a comprehensive overview of their portfolio performance over specific periods. This tool proves invaluable for investors and chartered accountants in tax filing and wealth management. By offering a centralized platform for portfolio management, Zerodha enhances user convenience and fosters a holistic approach to financial planning.

✨ Diversifying Investment Avenues

Zerodha’s evolution goes beyond traditional brokerage services. The platform has strategically expanded its product mix, now encompassing gold investing, international equities trading, bonds platforms, and mutual fund investments. This diversification not only enriches the investment landscape for users but also extends the lifetime value of their engagement with Zerodha.

✨ Linguistic Inclusivity Through Regional Languages

Born in Bengaluru, Zerodha has transcended linguistic boundaries by offering its services in 12 Indian languages. This move goes beyond convenience—it supports the democratization of finance. By onboarding first-time investors in their native tongue, Zerodha addresses geographic and socioeconomic barriers, making financial services accessible across diverse regions of India.

✨ Technological Advancement

Zerodha’s ascent has triggered a ripple effect in the brokerage industry. Incumbent brokerages, such as ICIC and HDFC, compelled by Zerodha’s success, have raced to match its technological capabilities and transparent pricing. This pursuit of user-centricity not only modernizes established players but also enhances market-wide accessibility, ushering the entire industry into a new era.

✨ Inclusive Investing by Fostering Retail Participation

Zerodha’s commitment to educating and empowering users has transformed the investing landscape. By making investing more approachable, the platform has played a pivotal role in boosting retail participation. Impressively, over 15% of new demat account openings in India now flow through Zerodha, signifying a significant shift in the investment landscape, particularly in Tier 2/3 cities.

✨ Industry Leadership Recognition

Zerodha’s founder, Nithin Kamath, has received notable recognition as a key influencer shaping India’s startup ecosystem, earning the prestigious TiE50 award. This acknowledgment not only affirms Kamath’s leadership but also cements Zerodha’s reputation as a trailblazer dragging India’s brokerage space into the 21st century. As an industry leader, Zerodha’s impact extends beyond its platform, influencing the broader narrative of innovation and excellence in the financial services sector.

👉 Conclusion: Sailing Towards Financial Success

In the ever-shifting landscape of financial services, a well-crafted marketing plan serves as the compass steering institutions toward success. From building trust and differentiation to targeting the right audience, ensuring compliance, and enhancing brand visibility, the strategic elements encapsulated in a marketing plan are the keystones of sustained success. As the sector evolves, the institutions equipped with this strategic compass not only navigate change but actively shape the narrative of triumph and client satisfaction. In the fusion of financial acumen and strategic marketing lies the roadmap to enduring success in the dynamic world of financial services.

More reasons to trust us!

Excellis IT is building a skilled team in IT support, customer support, digital marketing, and back-office services for modern companies.

Excellis it is an esteemed ISO/IEC 27001:2022 certified company

We achieved the prestigious certification by MSME in 2019

We are certified by the Central Vigilance Commission

We are an honoured members of NASSCOM since 2022